The introduction of the federal corporate tax in the United Arab Emirates (UAE) has created a new compliance framework for businesses operating within the country. Companies are required to register, file tax returns, and pay any tax due in accordance with the timelines set by the Federal Tax Authority (FTA). Failure to comply with these deadlines results in penalties, which can accumulate quickly and impact a company’s financial standing. This article provides a comprehensive overview of the penalties associated with late corporate tax filing in the UAE, including fines, interest, and potential legal consequences. Consult Vat Registration UAE experts for detail.

Overview of Corporate Tax Filing Requirements

All businesses in the UAE that meet the taxable income threshold must file a corporate tax return. The standard filing requirement is:

- Due Date: 9 months after the end of the company’s financial year.

- Payment: Any tax due must also be settled by this date.

For example:

- If a company’s financial year ends on December 31, 2024, the corporate tax return and payment are due by September 30, 2025.

- If the year-end is March 31, 2025, the deadline is December 31, 2025.

Failure to meet these deadlines triggers penalties and interest.

Types of Penalties for Late Filing

The UAE corporate tax law imposes penalties based on the severity and duration of non-compliance. The primary types of penalties include:

- Penalty for Late Filing

A company that fails to file its corporate tax return by the due date is subject to a fixed penalty:

- AED 1,000 for returns filed within 90 days after the due date.

- AED 2,000 for returns filed after 90 days from the due date.

This penalty applies regardless of whether any tax is owed.

- Penalty for Late Payment

If a company files the tax return on time but fails to pay the tax due, interest is charged on the unpaid amount. The interest is calculated from the day after the due date until the date of full payment.

- Interest Rate: Determined by the FTA and may change periodically.

- This encourages timely payment to avoid additional financial liability.

- Penalty for Incorrect or Incomplete Filing

Submitting inaccurate or incomplete information can also lead to penalties. Examples include:

- Misreporting taxable profits.

- Omitting transactions.

- Failure to provide supporting documentation when requested.

The FTA may issue fines for each inaccuracy, and repeated violations can lead to more severe enforcement actions.

- Cumulative Effect

Late filing, late payment, and inaccuracies can lead to cumulative penalties, significantly increasing the financial impact on the company.

Consequences of Non-Compliance Beyond Penalties

In addition to monetary fines, companies that repeatedly fail to comply with corporate tax obligations may face:

- Audit or Investigation: The FTA may initiate audits to verify financial records and tax calculations.

- Suspension of Business Licenses: Non-compliance could impact license renewals or permit approvals.

- Legal Action: Persistent non-compliance may result in legal proceedings, including potential prosecution under UAE tax law.

- Damage to Reputation: Companies with poor compliance records may face difficulties in securing contracts, especially government tenders, which require ICV or tax compliance documentation.

Best Practices to Avoid Late Filing Penalties

To avoid penalties and maintain compliance, companies should adopt the following best practices:

- Maintain Accurate Records

Keep detailed financial statements, invoices, and documentation of all business transactions. Accurate bookkeeping ensures that taxable profits are calculated correctly and reduces the risk of errors.

- Monitor Deadlines

Set internal reminders for filing and payment deadlines at least 1-2 months in advance. Using digital calendars or compliance software can help prevent accidental delays.

- File Early

Filing the corporate tax return well before the due date allows time to address discrepancies, gather required documentation, and consult with tax advisors if necessary.

- Engage Professional Tax Advisors

Certified accountants or tax consultants familiar with UAE corporate tax regulations can help:

- Prepare and review the tax return.

- Ensure correct tax calculations.

- Handle documentation for audits or inquiries.

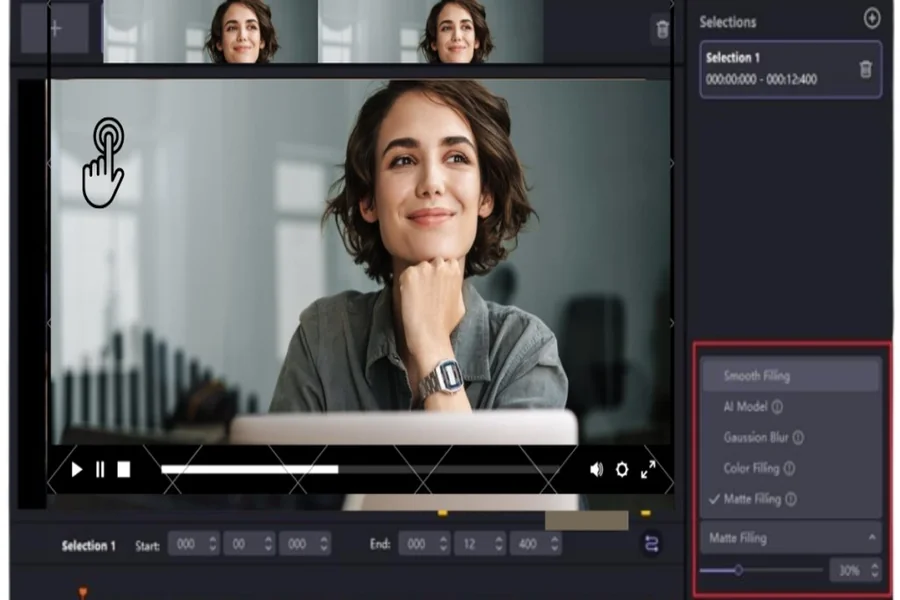

- Use the FTA Portal Efficiently

The FTA online portal allows businesses to file returns, calculate tax, and make payments securely. Ensuring access and familiarity with the portal reduces delays caused by technical issues.

Example Scenario of Penalty Calculation

Assume a company with a financial year ending December 31, 2024, fails to file its tax return by September 30, 2025 and instead submits it 60 days late.

- Late Filing Penalty: AED 1,000 (within 90 days).

- Tax Due: AED 50,000.

- Late Payment Interest: Calculated daily until payment is made.

If the company waits 120 days, the late filing penalty increases to AED 2,000, plus additional interest on the unpaid AED 50,000.

This scenario illustrates how quickly penalties and interest can accumulate.

Conclusion

The UAE’s corporate tax framework emphasizes timely filing and payment as a key aspect of compliance. Penalties for late corporate tax filing include fixed fines for delays, interest on unpaid tax, and additional penalties for inaccurate reporting. Non-compliance can also lead to audits, license issues, and reputational damage.

Businesses can mitigate risks by maintaining accurate records, monitoring deadlines, filing early, and engaging professional tax advisors. Adhering to deadlines is not just about avoiding penalties; it demonstrates financial discipline, enhances credibility with stakeholders, and ensures smooth operation within the UAE’s regulatory framework.